In April of 2018, the California Supreme Court changed the game for people who thought they were independent contractors.

In April of 2018, the California Supreme Court changed the game for people who thought they were independent contractors.

The Supreme Court ruled that a worker was presumed to be an employee (and not an independent contractor) for purposes of California’s Wage Orders unless three conditions were met:

(A) The individual is free from control and direction in connection with the performance of the service, both under his contract for the performance of service and in fact; and

(B) The service is performed outside the usual course of the business of the employer; and,

(C) The individual is customarily engaged in an independently established trade, occupation, profession, or business of the same nature as that involved in the service performed.[1]

This completely upended the “gig economy” concept. Suddenly Uber drivers, Postmates delivery workers, real estate agents, salons and barbers, and many other industries that had relied heavily on having “independent contractors” now had hundreds of thousands of workers who suddenly had a very strong (but unresolved) case that they should be treated as employees, not independent contractors.

The difference between an independent contractor and an employee is not just a label. By having a worker be an “independent contractor” instead of an employee, a worker typically doesn’t have the right to minimum wage, overtime, doesn’t have the right to organize and isn’t protected by legislation that protects employees from discrimination in the workplace (among many other rights).

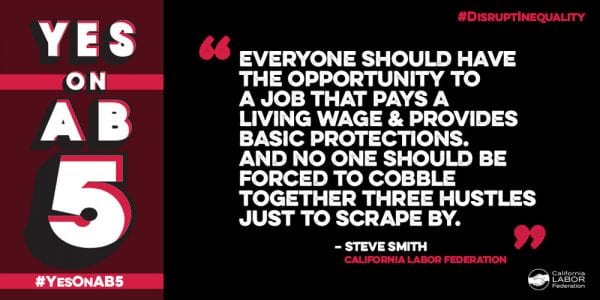

This emboldened a new push in the California legislature – to codify the Dynamex decision (meaning, make it the written law of the state of California) and clarify it’s scope. Assemblywoman Lorena Gozalez (D-San Diego) introduced AB 5, a measure intended to clarify how the new rules for “independent contractors” should apply.

Companies and workers would both find this helpful. A court decision typically is limited to the dispute in front of it—Dynamex happened to involve a trucking company. How do its rules apply to other businesses? As one prominent employer defense firm noted, there are several very real questions workers and companies face:

“For example, what is the “usual course of business” of a retail store? . . . . What if the retail store is part of a large chain that has its own maintenance staff that includes plumbers and electricians? Are maintenance and repairs then part of the usual business of the retail store? If so, if it still hires an outside plumber or electrician, does that create an employment relationship? . . . What if the electrician is a retired electrician that happens to be a friend of the store manager, and offers to fix whatever electrical issue exists for a small fee? Is he an employee?”[2]

Fair questions, but which way should they resolve?

[1] Dynamex Operations West v. Superior Court (2018) 4 Cal.5th 903

[2] Credit to William Hayes Weissman of Littler Mendelson P.C.. His paper can be found online here.